Episode: 233

The #1 Money Rule to Live By: Understand The Psychology of Money

with Farnoosh Torabi

Ready to take control of your finances?

Whether you want to start saving, make more, or get out of debt, this episode will lay the foundation for your financial success.

In this episode, financial expert Farnoosh Torabi will uncover major money myths that leave you feeling trapped and the steps you need to take to get good with money and build wealth.

Your past financial fears don’t define your future. You have the power to rewrite your story.

Farnoosh Torabi

Featured Clips

All Clips

Transcript

Share With a Friend

Key takeaways

Fear around money isn’t weird, it’s universal. For most of us, it’s the loudest, most constant voice in our head.

You don’t need to be fearless. You need to get curious about what your fear is trying to tell you and use it to fuel action.

When you grow up watching money cause stress, silence, or shame, that story sticks until you decide to write a new one.

Being financially independent is your birthright, and it’s how you gain real power over your own life.

Financial freedom doesn’t start with money — it starts with knowing what you value and refusing to let fear make your decisions.

Guests Appearing in this Episode

Farnoosh Torabi

Farnoosh Torabi is a financial expert, bestselling author, and podcast host dedicated to empowering people to achieve financial independence.

-

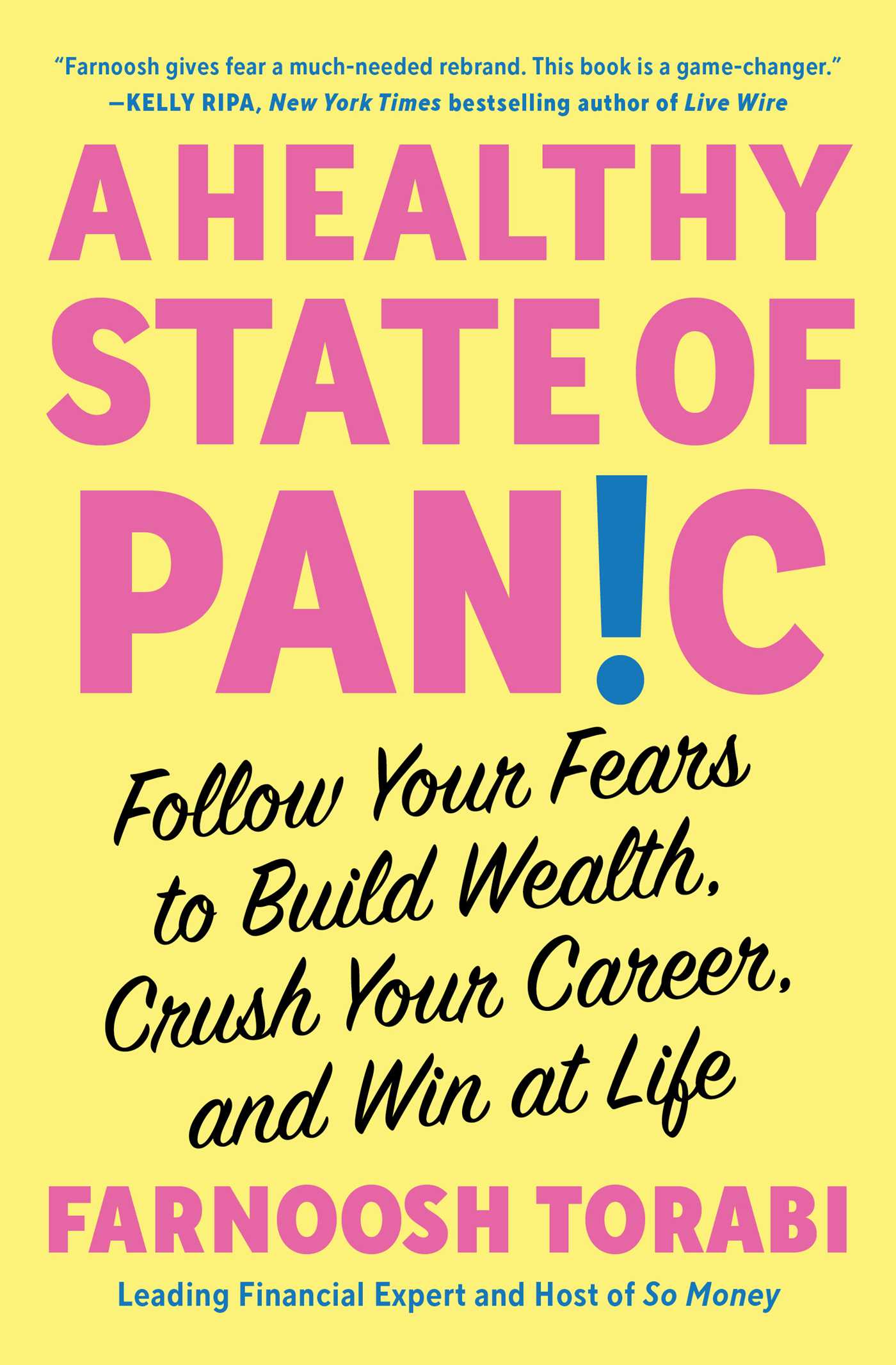

Books

Farnoosh Torabi is familiar with fear. Growing up in the 1980s as the daughter of Iranian immigrants, she was warned to always play it safe. She spent her childhood immersed in fear—of rejection, loneliness, missed opportunities, and falling short of her potential. Of course, now her mother says, “It all worked out, didn’t it?” Funnily enough, it did. Farnoosh came to the realization that fear never limited her. Instead, it has become a friend, opening her world and equipping her with the tools and street smarts to navigate life’s trials and thrive on her own terms.

Discover how you can become more self-reliant and financially resilient, invite calm and control into your daily routine, and how fear can serve you with this “wise, witty, and illustrative guide” (Eve Rodsky, New York Times bestselling author) to building your best life.

-

Podcast: So Money

So Money® brings candid conversations about money with the world’s top business minds, authors and influencers including Arianna Huffington, Tim Ferriss, Gretchen Rubin, Seth Godin, Robert Kiyosaki, Jim Cramer, Margaret Cho and many others. On Fridays, tune in as Farnoosh tackles your biggest money questions on #AskFarnoosh

Resources

-

- Psychology Today: Financial Fears: It’s not Always About the Money

- Forbes: The Psychology of Money: What You Need To Know To Have A (Relatively) Fearless Financial Life

- Advances in Experimental Social Psychology: Between Hope and Fear: The Psychology of Risk

- Forbes: How Financial Independence Transforms Women’s Lives

- European Institute for Gender Equality: What’s gender equality got to do with financial independence?

- Educational Gerontology: Older Women and Financial Management: Strategies for Maintaining Independence

- Journal of Consumer Affairs: The Intergenerational Transference of Money Attitudes and Behaviors

- Journal Research on Adolescence: Financial Behaviors, Couple-Level Conflict, and Adolescent Relationship Abuse: Longitudinal Results From a Nationally Representative Sample

- Journal of Business Venturing: Aspiring to succeed: A model of entrepreneurship and fear of failure

- American Psychological Association: Take the money now or later? Financial scarcity doesn’t lead to poor decision making

- Journal of Economic Psychology: The prospective associations between financial scarcity and financial avoidance

- TIAA Institute: TIAA Institute report finds ties between financial stress and mental health

- Journal of Family and Economic Issues: The Relationship Between Financial Worries and Psychological Distress Among U.S. Adults

- Psychology Today: 2 Simple Steps to Raise Your ‘Financial Self-Esteem’

- Personality and Social Psychology Bulletin: It’s All About the Money (For Some): Consequences of Financially Contingent Self-Worth

- USA.gov: Learn about your credit report and how to get a copy

- Intuit CreditKarma: Check your credit score for free here

- Caroline Dooner: Tired as F*ck